Linear mortgage

The linear mortgage, along with the annuity mortgage, is the most frequently chosen mortgage type. Since 2013, these are still the only two mortgage types where you, as a starter, can claim mortgage interest tax deduction. On this page, we will tell you more about the concept of the linear mortgage.

What is a linear mortgage?

A linear mortgage is a mortgage where you repay the same amount each month over the term. This means you pay off your linear mortgage evenly. The amount you repay depends on the amount of the principal and the term of the mortgage.

The mortgage interest you have to pay each month actually decreases during the term. This is because you pay the interest on the remaining debt, which gets progressively lower due to the repayments. At the same time, this also means that your tax advantage decreases during the term. In the beginning, you have a lot of mortgage interest tax deduction, later on less and less.

Features of a linear mortgage

- The mortgage has a fixed end date;

- During the term, you pay off the same amount every month;

- You have certainty that you will repay the mortgage;

- Repayment and interest (gross monthly cost) are high at the beginning and low at the end.

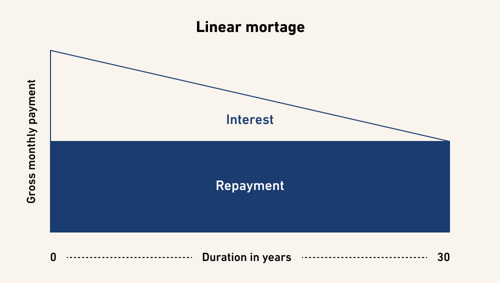

Linear mortgage graph

The chart below gives an example of how a linear mortgage is structured.

How does linear repayment work?

With a linear mortgage, you pay the same amount in repayment every month. Suppose you have chosen a mortgage term of 30 years (or 360 months), you will thus pay off 1/360th of the total mortgage each month via linear repayment. As a result, the mortgage debt goes down in a straight line (hence the term linear), as do the interest expenses. Are you at the end of the mortgage term? Then the mortgage is fully repaid. By the way, you are not obliged to opt for the maximum term of 30 years: a shorter term is also allowed. The minimum term of a linear mortgage varies between mortgage lenders.

What is the advantage of a linear mortgage?

Choosing a linear mortgage will give you a number of advantages. Such as:

- It is a very easy-to-understand type of mortgage;

- You pay the same amount every month to repay your mortgage debt;

- Your mortgage debt gets lower every month;

- The mortgage interest you pay decreases over the term;

- At the beginning of the term, you benefit from a lot of mortgage interest tax deductions.

Disadvantages of a linear mortgage

There are still a few disadvantages to choosing a linear mortgage. At the end of the term, your tax advantage is much lower than at the beginning. You then pay less interest, which reduces your mortgage interest tax deduction. In addition, your monthly costs are actually relatively high at the beginning compared to other mortgage types.

Which is better: annuity or linear mortgage?

If you care about paying off your mortgage quickly, a linear mortgage makes sense. During the term, your monthly amount also gets lower and lower and you have less "costs" over the entire term than with an annuity mortgage. The advantage of an annuity mortgage is that you mainly pay a lot of interest at the beginning, allowing you to make maximum use of the mortgage interest tax deduction.

Calculate linear mortgage

Want to calculate your linear mortgage yourself? The calculation example below shows how it works. The interest charges fall each year and your repayment portion remains the same each year. As a result, both the total gross expenses and the net expenses per year decrease. The tax benefit per year decreases because you pay less interest.

Example of linear mortgage calculation:

Suppose you need a mortgage of €216,000. And a linear mortgage is the best choice for you. The term for your mortgage is 30 years (= 360 months) and the mortgage interest rate is 4%.

The table shows that in 30 years (= 360 months) you then pay off €600 each month on your linear mortgage: €216,000 / (30 years x 12 months).

| Month | Mortgage principal at start of month | Repayment | Interest | Gross monthly payment |

| 1 | € 216,000 | € 600 | € 720 | € 1320 |

| 2 | € 215,400 | € 600 | € 718 | € 1318 |

| 3 | € 214,800 | € 600 | € 716 | € 1316 |

| 4 | € 214,200 | € 600 | € 714 | € 1314 |

| 5 | € 213,600 | € 600 | € 712 | € 1312 |

| " | " | " | " | " |

| 355 | € 3,600 | € 600 | € 12 | € 612 |

| 356 | € 3,000 | € 600 | € 10 | € 610 |

| 357 | € 2,400 | € 600 | € 8 | € 608 |

| 358 | € 1,800 | € 600 | € 6 | € 606 |

| 359 | € 1,200 | € 600 | € 4 | € 604 |

| 360 | € 600 | € 600 | € 2 | € 602 |

What does a linear mortgage cost?

The cost of a linear mortgage is, of course, primarily the amounts you pay monthly in interest and repayment. And as you know by now, that amount consists of a fixed amount for repayment and an ever-decreasing amount for interest. In addition, when you buy a house, in many cases you pay buyer's fees. And if you want to take out a linear mortgage through De Hypotheker, you will additionally pay for our services. The first intake interview at one of our branches is non-binding and therefore costs you nothing at all. If you decide to take out a mortgage through us, certain guide prices apply.

Linear mortgage fast-tracked to zero

It is possible to repay your linear mortgage faster. For more information on this, please contact one of our mortgage advisors at a branch near you.