Annuity or linear: this is the difference

Do you choose an annuity or a linear mortgage? We list the main differences and advantages for you.

If you are going to choose the right mortgage, it is especially important to determine what you can pay per month. Not only now but also in the future. On that basis, you estimate whether, for example, a linear or annuity mortgage is suitable for your situation. Both mortgage types consist of a monthly amount composed of repayment and interest. With an annuity mortgage, you pay the same amount every month. That seems more attractive than a linear mortgage, where you pay more per month for the first few years. But is that really the case? Here we give you more information on the difference between annuity and linear.

Difference between annuity and linear

As a first-time homebuyer, since the rules on mortgage interest relief were tightened on 1 January 2013, you really only have two mortgage types to choose from: an annuity or a linear mortgage. Want to know more about what the difference between annuities and a linear mortgage is?

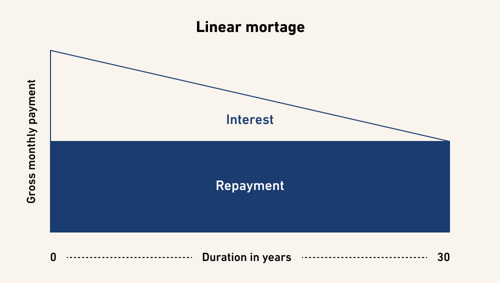

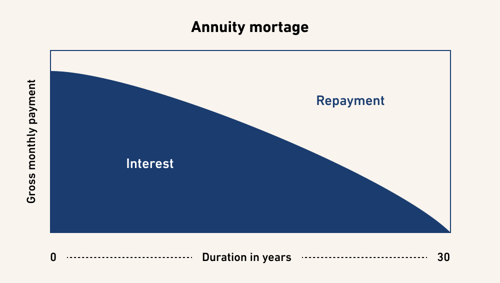

With an annuity loan, you mainly pay a lot of interest in the first few years and only pay off more later in the term. With a linear mortgage, you pay an equal amount in repayments every month. In this way, you repay more quickly and the monthly amount becomes lower and lower. After all, the amount you pay interest on becomes smaller and smaller. Over the entire 30-year term, with a linear mortgage you also have even less "costs" in total than with an annuity mortgage.

Still, the annuity mortgage is the most chosen mortgage form of the two. This is mainly due to the lower monthly fees at the beginning of the term. What is best for your situation when looking at annuity or linear, mainly has to do with your personal situation. Therefore, always get proper advice.

Similarities between an annuity mortgage and a linear mortgage

The main similarity between the annuity and linear mortgage, is that in both cases you pay off your mortgage in full within 30 years. This is also the reason why you can claim mortgage interest tax deduction only with these mortgage types. In both cases, it is also the case that this benefit decreases during the term of the mortgage, because you pay a lot of mortgage interest especially at the beginning. Moreover, the mortgage interest tax deduction is reduced to a maximum of 37%.

Which is better: annuity or linear?

Actually, when choosing annuity or linear, the main question is whether you care about paying off your mortgage quickly or are in no hurry to do so. And how much you want to spend in total. A linear mortgage pays off faster and is therefore cheaper over the entire duration.

Annuity vs linear: when do you choose which?

Do you not have that much money to spend in the first few years? Then an annuity mortgage is more appropriate than a linear mortgage. As long as interest rates are still low, a linear mortgage is also quite affordable if you are not yet at your peak income.

Do you have a desire to have children? Then you know that part of your income will soon be spent on your children. In that case, it is nice that you are paying less and less for your mortgage. Even if you want to work less one day in the future or even stop working altogether, it is nice to have lower housing costs after a few years.

Combination of linear and annuity mortgage

It is also possible to combine a linear and an annuity mortgage. Your mortgage then consists of two loan parts. You repay one part on an annuity basis and the other on a straight-line basis. An advantage of this is that you can create a mortgage with reasonably stable monthly costs over the entire term.

Are you curious whether your ideal mortgage is an annuity or linear mortgage, or a combination? Our advisors will be happy to tell you more about this. Make an appointment with one of our experts for independent advice on the best mortgage for your situation!