What is an annuity mortgage?

An annuity mortgage is a type of mortgage where the monthly sum of interest plus repayment remains the same, during the fixed-interest period. At the end date, the entire mortgage is repaid.

How does an annuity mortgage work?

Your total monthly payments with an annuity mortgage remain the same during the fixed-interest period. The amount you pay each month is called the annuity. The monthly amount consists of an annuity repayment and interest.

Along with the linear mortgage, the annuity mortgage is the most commonly taken out. Since 2013, these are still the only two mortgage types where you, as a first time buyer, can claim mortgage interest tax deduction.

How much do you have to repay with an annuity mortgage?

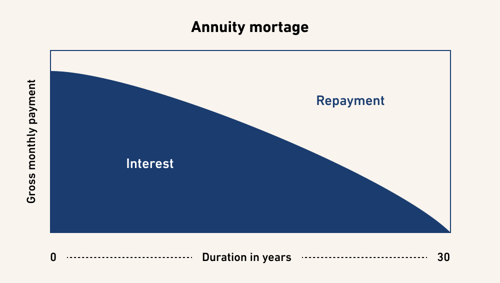

The composition of the amount you pay monthly with an annuity mortgage changes from month to month. In the beginning, the monthly costs with an annuity mortgage consist largely of interest and the repayment share is small. At the end of the term, on the contrary, the interest share is small and the repayment share is large. This means that your tax advantage decreases over the term. This is because you have a lot of interest deduction at the beginning, but much less later on.

Features of an annuity mortgage

- The annuity mortgage has a fixed end date;

- You make periodic repayments during the term;

- Your monthly costs (interest and repayment) are the same every month;

- You have certainty of paying off the mortgage.

Annuity mortgage graph

The chart below gives an example of how an annuity mortgage is structured.

Advantages annuity mortgage

An annuity mortgage has the following advantages:

- At the end of the term, you will have paid off your mortgage

- The mortgage interest rate decreases over the term

Your gross monthly costs remain the same during the term

At the start of the term, you have a lot of interest relief

Disadvantages annuity mortgage

There is also an important disadvantage to choosing an annuity mortgage. This is because your tax advantage over the term of the mortgage decreases.

Annuity or linear: which do you choose?

With an annuity mortgage, the amount you repay is low in the initial period and towards the end of the term, your repayment amount is high. With a linear mortgage, the amount you repay is the same throughout the term. But which is the best choice for you if you want to take out a new mortgage?

Repaying your annuity mortgage

Repaying your annuity mortgage is initially automatic by paying your monthly mortgage payments. In fact, part of this involves paying off the mortgage debt. At halfway through the term of an annuity mortgage, you will have repaid about a third of the total mortgage. Are you at two-thirds of the term? Then about half of the mortgage amount has been repaid.

Additional repayment annuity mortgage

You can also consider making extra repayments on your annuity mortgage. You then decide how much you want to repay extra. The advantage of paying off your annuity mortgage is that your monthly costs are lower. On the other hand, you will have less money left in your savings account. Are you going to repay your annuity mortgage? Then it's always wise to discuss with your adviser beforehand whether extra repayments can be advantageous for you.

Please note: if you make an interim repayment, you may have to pay penalty interest. The conditions under which you can redeem your annuity mortgage without penalty can be read in the mortgage conditions or mortgage deed. Be well informed whether extra repayments are profitable for you. Our mortgage advisors can tell you more about it. Make an appointment.

Calculate an annuity mortgage using a formula

You can calculate the amount of an annuity with a formula. But to be perfectly honest: it is quite complicated to explain in short. That is why we have drawn up the calculation example below, which shows you at a glance what the amount of the annuity will be from month to month. Among other things, you can see that you pay the same amount in repayments every month and that the interest rate decreases. At the beginning of the term, you pay (almost) only interest. As the term of the annuity mortgage progresses, this interest amount also decreases.

Calculation example annuity mortgage

Suppose you want to buy a house and you need a mortgage for this of € 216,000. The term for your mortgage is 30 years and the mortgage interest rate is 4%. If you then start calculating your annuity, you discover that the monthly annuity is €1,031.21. This is your gross monthly charge consisting of a part repayment (€311 in the first month) and a part interest (€720). In the first month, you pay €720 in interest: 4% interest on €216,000 totalling €8,640 divided by 12 months. Your gross monthly charge remains the same each month. Only the composition of your gross monthly charge differs. So the amount you repay goes up and the interest rate goes down.

| Month | Mortgage principal at start of month | Repayment | Interest | Gross monthly payment |

| 1 | € 216,000 | € 311.22 | € 720.00 | € 1,031.21 |

| 2 | € 215,688.78 | € 312.25 | € 718.96 | € 1,031.21 |

| 3 | € 215,376.53 | € 313.30 | € 717.92 | € 1,031.21 |

| 4 | € 215,063.23 | € 314.34 | € 716.88 | € 1,031.21 |

| 5 | € 214,748.89 | € 315.39 | € 715.83 | € 1,031.21 |

| " | " | " | " | " |

| 355 | € 6,115.75 | € 1,010.83 | € 20.39 | € 1,031.21 |

| 356 | € 5,104.92 | € 1,014.20 | € 17.02 | € 1,031.21 |

| 357 | € 4,090.72 | € 1,017.58 | € 13.64 | € 1,031.21 |

| 358 | € 3,073.14 | € 1,020.97 | € 10.24 | € 1,031.21 |

| 359 | € 2,052.17 | € 1,024.38 | € 6.84 | € 1,031.21 |

| 360 | € 1,027.79 | € 1,027.79 | € 3.43 | € 1,031.21 |