Mortgage types in The Netherlands

When you take out a mortgage, you take out a loan where the house serves as collateral. There are different ways to repay this loan, or different mortgage types. De Hypotheker lists all different mortgage types for you.

Mortgage types in the Netherlands

If you take out a mortgage, you take out a loan with the house as collateral. There are different ways to repay this loan, in other words, different mortgage types. As of 2013, you are only eligible for mortgage interest deduction if you take out an annuity mortgage or a linear mortgage. These are the most common mortgage types nowadays.

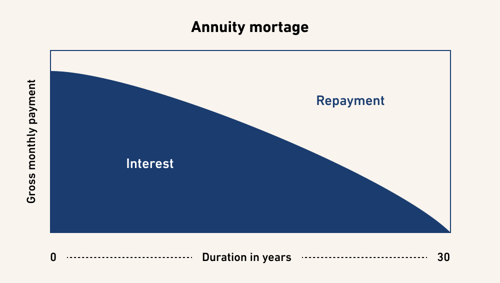

Annuity mortgage

An annuity mortgage is a mortgage in which the monthly sum of interest plus repayment remains the same throughout the entire term. In the beginning of the term, you mainly pay a lot of interest and as the mortgage progresses, you will pay off more. The entire mortgage is repaid on the maturity date. An annuity mortgage has the following characteristics:

- The mortgage has a fixed maturity date;

- During the term you redeem periodically;

- Your (gross) monthly costs are the same every month;

- You have certainty that you will pay off the mortgage.

For whom is an annuity mortgage suitable?

You can choose an annuity mortgage if you expect to be able and want to spend more money on your mortgage payments in the future. For example, if you are still at the beginning of your career and expect your salary to rise.

This is because as the term of an annuity mortgage progresses, you pay more repayments and less interest, so you can benefit less from the mortgage interest deduction and your net monthly costs increase. So the annuity mortgage is less suitable if you actually want to spend less money on mortgage payments in the future.

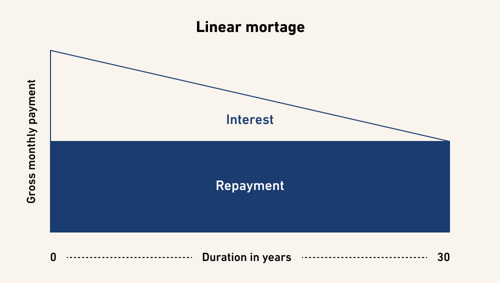

Linear mortgage

A linear mortgage is a mortgage in which you pay off the same amount every month during the term. The interest you pay is getting lower and your monthly expenses decrease. The characteristics of a linear mortgage are:

- The mortgage has a fixed maturity date;

- You repay the same amount every month during the term;

- In the beginning you pay a lot of interest, in the end little;

- You have certainty that you will pay off the mortgage.

For whom is a linear mortgage suitable?

A linear mortgage may suit you if you currently have room to spend a little more on your mortgage burden and want to have more money left over for other things in the future.

Annuity or linear: this is the difference

If you are going to choose the right mortgage, it is especially important to determine what you can pay per month. Not only now but also in the future. Based on this, you will estimate what the most favourable mortgage type is for your situation.

Other mortgage types

Until 2013, it was possible to get mortgage interest deductions even for mortgage types other than annuity and linear mortgages. However, most mortgage types can no longer be taken out. Only if you are eligible under the 'transitional law' (if you took out your mortgage before 31 December 2012), you can still continue the mortgage (for tax purposes). For more information, contact an advisor at De Hypotheker.

Below is an overview of the different types of mortgage in 2025.

- Repayment-free mortgage

With an interest-only mortgage, you are not obliged to repay during the term. On the end date, you repay the entire loan in one go. During the term, you only pay interest on the mortgage debt. - Savings mortgage

A savings deposit mortgage is a type of mortgage where no repayments are made during the term. Instead, you save money each month in a capital insurance policy to pay off your mortgage. At maturity, you use the accrued value of the endowment insurance to repay the mortgage. With a savings deposit mortgage, the interest you receive on the savings balance is equal to the mortgage interest payable. - Bank savings mortgage

A bank savings deposit mortgage is a type of mortgage where no repayments are made during the term. However, you set aside money each month to pay off your mortgage. This money is placed in a blocked savings account, which is used exclusively to repay your mortgage debt. On the end date of your bank savings mortgage, the balance in your savings account is released, and you pay off your mortgage in one go. - Life mortgage

A life mortgage is a form of mortgage where no repayments are made during the term. Instead, a life insurance policy is taken out where you build up capital and use it to pay off the mortgage at the end of the term. - Hybrid mortgage

The hybrid mortgage is also known as a savings or investment mortgage. This type of mortgage combines the flexibility of a life mortgage and the security of a savings deposit mortgage. You have no compulsory repayment during the term and the fixed monthly costs consist of interest and premium. - Equity-linked mortgage

With an equity-linked mortgage, you build up the capital to repay via investments. Investments are made for you in mutual funds through a separate investment account. You invest through a one-off or periodic deposit in mutual funds. - Credit mortgage

A credit mortgage can be compared to a continuous credit, with your home serving as collateral. You can then dispose of the assets tied up in your house. This form of mortgage is often used as an alternative to a normal continuous credit and not as a form of mortgage to finance a home.

Which mortgage type is the cheapest?

Since there are different mortgages, the amounts you pay in interest and repayments can also be different with each mortgage form. Many wonder which mortgage form is the cheapest. Unfortunately, that is not so easy to pinpoint. Each mortgage type has advantages and disadvantages and, again, you cannot always compare them one to one. For example, the linear mortgage is the cheapest if you consider the mortgage interest deduction it offers. With a repayment-free mortgage, the monthly costs are lower because you only pay interest there, but at the end of the term you are still left with a residual debt. So the answer to the question "which type of mortgage is cheapest?" is difficult to answer. Make an appointment with one of our advisors to discuss the options for your situation.

Which mortgage types are deductible?

Want to know which mortgage forms are deductible in your income tax return in 2024? Since 2013, as a starter, you only get interest deduction for a linear or annuity mortgage. This has to do with the fact that here you make monthly repayments and that the mortgage is fully repaid at the end of the term. Did you take out a non-linear or annuity mortgage before 2013? Then the mortgage interest deduction does continue to apply to you (up to a maximum of 30 years). Even if you move house or refinance your mortgage. If you increase your mortgage, the new rules do apply.

What is the best type of mortgage for first-time buyers?

Are you a first-time buyer and want to know which mortgage forms you are eligible for? If you want to benefit from the mortgage interest deduction, you only have a choice between a linear mortgage and an annuity mortgage. So if you choose another mortgage form, the interest you pay is not deductible. Most first-time buyers don't want to miss out on this benefit. Although nowadays you also increasingly see young homebuyers opting for a (partly) repayment-free mortgage again due to low interest rates. They don't mind the tax advantage they miss out on as they also get lower monthly costs with an interest-only mortgage.